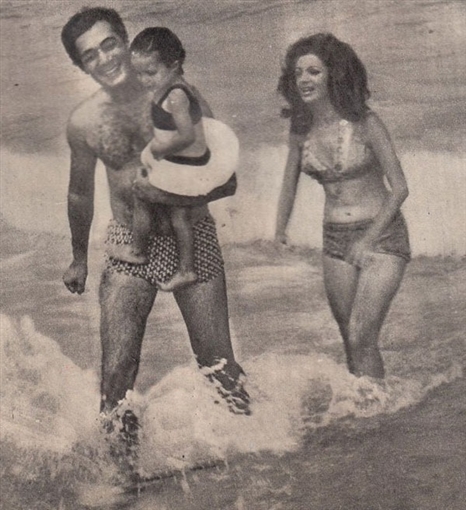

كان البحر وجهة الفنانين للتخلص من الضغوط والمشاكل والوصول للراحة والاستجمام كما كان ملتقى فناني الزمن الجميل مع بعضهم البعض.

بعيدا عن الأضواء والشهرة، كانت شواطيء الأسكندرية المكان الأفضل للاسترخاء عكس الآن حيث يقضي الفنانون إجازاتهم الصيفية في الدول الأوروبية وجزر المالديف والساحل الشمالي.

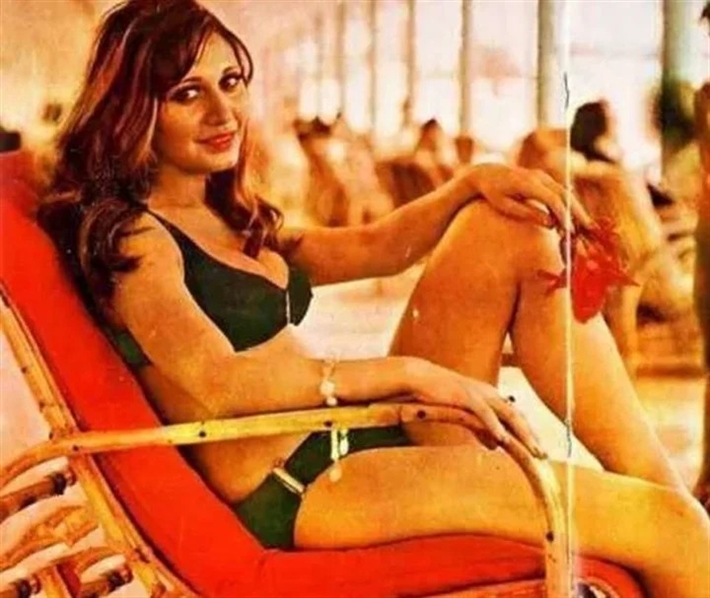

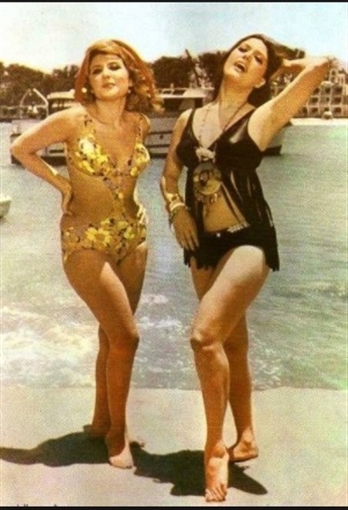

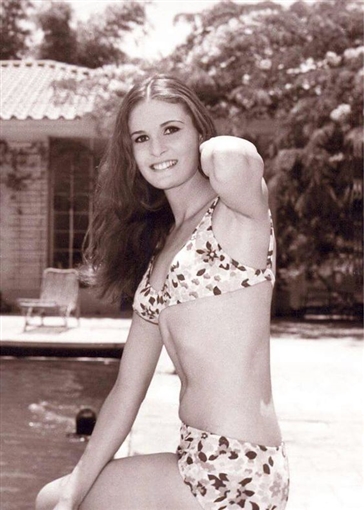

وكان ارتداء الفنانات للمايوه جزءا لا يتجزأ من استمتاعهن بالعطلة الصيفية وفي الألبوم التالي نشاهد نجمات بالمايوه على شاطيء البحر..

فى هذا التقرير نستعرض لكم ابرز صور مايوهات نجمات الزمن الجميل:

مع ارتفاع درجات الحرارة يهرب النجوم إلى الشواطئ ليستمتعوا بالإجازة بعيدا عن صخب المدينة.

وكما هو الحال الآن، كان البحر وجهة الفنانين للتخلص من الضغوط والمشاكل والوصول للراحة والاستجمام كما كان ملتقى فناني الزمن الجميل مع بعضهم البعض.

بعيدا عن الأضواء والشهرة، كانت شواطيء الأسكندرية المكان الأفضل للاسترخاء عكس الآن حيث يقضي الفنانون إجازاتهم الصيفية في الدول الأوروبية وجزر المالديف والساحل الشمالي.

وكان ارتداء الفنانات للمايوه جزءا لا يتجزأ من استمتاعهن بالعطلة الصيفية وفي الألبوم التالي نشاهد نجمات بالمايوه على شاطيء البحر

Life insurance is not always necessary or appropriate for everyone. Here are some situations when you may not need to buy life insurance:

You have no dependents:

If you are single and have no dependents, such as a spouse, children, or elderly parents, you may not need to purchase life insurance. Life insurance is designed to provide financial support to your dependents in the event of your death, and if you don’t have anyone relying on your income, there may be no need for this type of coverage.

You have enough assets to cover your final expenses:

If you have enough savings or other assets to cover your funeral expenses and any debts you may have, you may not need to purchase life insurance. However, keep in mind that life insurance can provide additional financial security for your loved ones in the event of your unexpected death, and can also be used to pay for other expenses, such as college tuition or a mortgage.

You have a limited budget:

If you are on a tight budget and cannot afford to pay the premiums for life insurance, it may be better to focus on building an emergency fund or paying off debts. However, keep in mind that life insurance premiums can vary widely based on factors such as your age, health, and coverage amount, so it’s worth shopping around to see if you can find a policy that fits your budget.

You have a terminal illness:

If you have a terminal illness, you may not be able to obtain life insurance or the cost may be prohibitively expensive. In this case, you may want to focus on other end-of-life planning, such as creating a will or setting up a trust.

You have a short life expectancy:

If you have a medical condition that is likely to shorten your life expectancy, such as advanced cancer or heart disease, you may not need life insurance as the benefit may not be paid out. However, if you have dependents who rely on your income, you may still want to consider purchasing a policy that provides a death benefit while you are still alive, such as a viatical settlement or accelerated death benefit.

Bounce

While life insurance is primarily designed to provide financial support to dependents in the event of your death, there are circumstances where it may not be necessary if you don’t have any dependents. Let’s explore some additional details to consider in such situations:

- Income Replacement: Life insurance is intended to replace your income to support your dependents’ financial needs after you’re gone. Without any dependents relying on your income, the main purpose of life insurance loses its significance.

- Cost of Premiums: Life insurance premiums can be costly, and the amount you pay may not be justified if you don’t have beneficiaries who would benefit from the death benefit. The expense might outweigh the potential benefits.

- Other Financial Priorities: Without dependents, your financial priorities might differ. Focusing on building an emergency fund, paying off debt, or saving for retirement could take precedence over purchasing life insurance.

- Investing the Money: Instead of spending on life insurance, you might consider investing the money in retirement accounts or other investment vehicles that offer long-term growth and financial security.

However, even without dependents, there can still be situations where life insurance may prove beneficial. For instance, if you have a co-signed loan or a business partner who relies on your income, life insurance could offer financial protection in the event of your unexpected passing.

Ultimately, the decision to purchase life insurance should be based on your individual circumstances and financial goals. While it may not be necessary without dependents, certain situations might warrant its consideration. Seeking advice from a financial advisor or insurance agent can help you assess your specific situation and determine whether life insurance aligns with your needs and objectives.